This article was produced for ProPublica’s Local Reporting Network in partnership with Documented. Sign up for Dispatches to get stories like this one as soon as they are published.

New York lawmakers proposed three new bills last week that would make it difficult for wage theft violators to conduct business in the state.

The legislation would bolster the power of state agencies to crack down on wage theft by stripping violators of their liquor licenses or business licenses, as well as issuing stop-work orders against them.

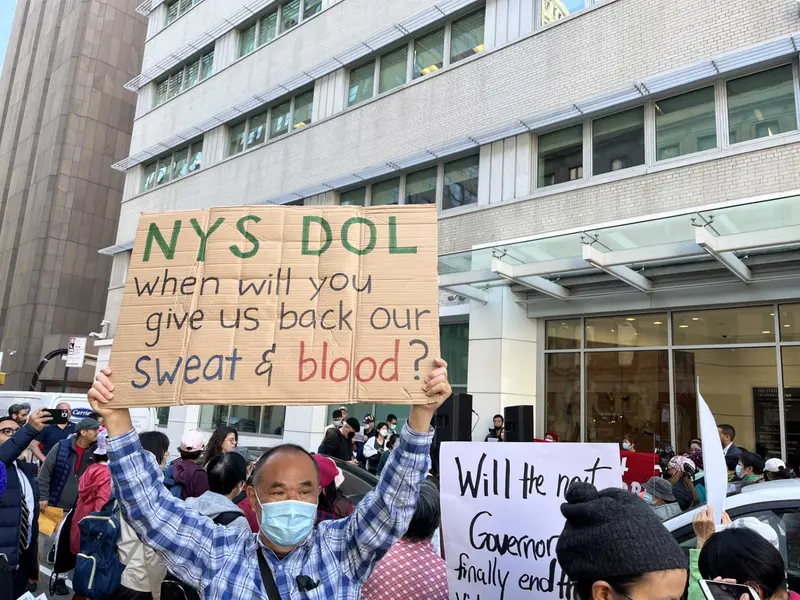

The legislation was prompted by reports of rampant wage theft against New York workers, including two investigations published by Documented and ProPublica. The stories revealed that more than 127,000 New Yorkers have been victims of wage theft during a recent five-year period, but that the New York State Department of Labor was unable to recover $79 million in back wages owed to the workers.

The stories were based on an analysis of two databases of wage theft violations obtained from the U.S. and New York Labor departments. The databases provided previously unreported details on how much money had been stolen from workers and also shed light on which businesses had committed wage theft.

“We knew from our conversations with labor and from our constituent service caseload that wage theft is a chronic problem,” said Sen. Jessica Ramos, a Democrat who sponsored the legislation. “We did not have the data to understand the scale of the issue in New York state until the ProPublica and Documented series came out last year. Having this reporting as a tool set us up to put this package together and focused our attention on” the capacity of the Department of Labor.

The legislation — dubbed the “wage theft deterrence package” by lawmakers — includes three bills, which are co-sponsored in the State Assembly by Assemblymembers Kenny Burgos, Harvey Epstein and Linda Rosenthal.

The first, S8451, would empower the New York State Liquor Authority to suspend liquor licenses for bars and restaurants that the Department of Labor has determined owe more than $1,000 in back wages to their workers. According to Documented and ProPublica’s analysis, more than $52 million has been stolen from people working in restaurants in New York, more than in any other industry. The amount of back wages accounted for more than 25% of all reported wage theft in the state. Similar measures have been successful in other parts of the country, including Santa Clara County in California, which has recovered $110,000 for workers since 2019.

The second bill, S8452, would enable the Department of Labor to place a stop-work order on any business that has a wage theft claim of at least $1,000. This approach has proven successful in other states, such as New Jersey, which temporarily shut down 27 Boston Market restaurants and eventually recovered more than $630,000 in back wages for 314 workers. Boston Market did not respond to a request for comment.

The third bill, S8453, allows the New York State Department of Taxation and Finance to suspend a business’s certificate of authority — which allows it to collect sales tax and conduct business — in cases where wage theft exceeds $1,000.

The three bills include a provision that allows employers to avoid the punishments if they resolve their wage theft claims within 15 days.

Ramos’ office told Documented and ProPublica that it’s too early to gauge the level of support among other lawmakers for the bills, which were introduced Wednesday. But Ramos and Rosenthal, a Democrat who represents the Upper West Side and the Clinton neighborhood in Manhattan, wield considerable clout in the Legislature, as they chair powerful committees — the Labor and Housing committees, respectively. And the bills have the support from the state Department of Labor, according to Ramos’ office.

“Each year, more than $1 billion is stolen from the pockets of hardworking New Yorkers by unscrupulous employers, often targeting the workers with the fewest resources to fight back,” Rosenthal said. “If businesses refuse to do the right thing and pay their workers what they are owed, New York State should hold them to account.”

The bills were praised by worker advocates and urban studies academics, including James Parrott, director of economic and fiscal policies at The New School’s Center for New York City Affairs. “These bills are needed to put more teeth into New York’s enforcement efforts,” Parrott said. “We owe it to hard-working low-wage workers and law-abiding employers.”