Millions of Americans will receive money from Intuit, the maker of TurboTax, as part of a $141 million settlement between the Silicon Valley company and all 50 states and the District of Columbia.

The company will send up to $90 apiece to more than 4 million people who paid for TurboTax software even though they were eligible to receive it for free.

The investigation by state attorneys general, led by Letitia James of New York, was sparked by ProPublica stories in 2019 that revealed how Intuit had systematically tricked millions of people into paying for tax prep.

“For years, Intuit misled the most vulnerable among us to make a profit,” James said in a statement. “Today, every state in the nation is holding Intuit accountable for scamming millions of taxpayers, and we’re putting millions of dollars back into the pockets of impacted Americans.”

The company, which has long defended its marketing practices, did not admit wrongdoing. In a statement, Intuit said it “agreed to pay $141 million to put this matter behind it.”

The deal covers those who paid to file with TurboTax for the tax years 2016 to 2018, even though they were eligible for a no-fee version of the software offered through the Free File program, launched by the industry in partnership with the IRS in 2003. Filers making below a certain threshold — $34,000 for the 2018 tax year — were eligible for TurboTax’s product offered through the program, as were those eligible for the federal Earned Income Tax Credit, as well as active duty military service members with low incomes.

The vast majority of the settlement will go directly to victims. For each year a person paid Intuit even though they were eligible to file for free, the company will send them approximately $30. The company is not facing any fines in addition to the restitution to be paid to TurboTax users.

The settlement follows three years of investigation and negotiations with Intuit involving attorneys for New York, Tennessee, Pennsylvania and other states.

Intuit’s deceptive practices predate 2016. ProPublica reported that they go back more than a decade. A person familiar with the state officials’ investigation said that the settlement did not cover tax years before 2016 because of some states’ statutes of limitations. TurboTax is a major profit driver for the company. Intuit generated around $3 billion in net income over the 2016 to 2018 time period.

The details of when and how the payments will be made are not immediately clear. The process will be overseen by a third party that will handle the logistics of distributing the money, according to the settlement, which says payments will be made by check or electronic services such as PayPal and Venmo. In Texas alone, more than 465,000 consumers are expected to receive restitution payments from Intuit, according to the settlement. More than 371,000 purchasers in California and more than 176,000 in New York are also expected to receive payments.

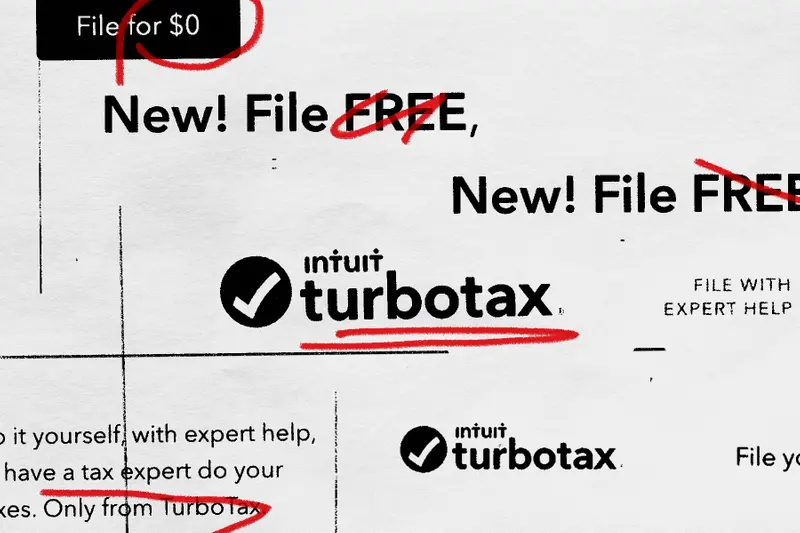

Under the terms of the settlement, Intuit will also have to take several steps to improve disclosure in its products and cease marketing TurboTax under its yearslong “free free free” ad campaign. The company said in its statement that it “already adheres to most of these advertising practices and expects minimal impact to its business from implementing the remaining changes going forward.”

ProPublica’s stories in recent years reported on how Intuit routinely charged Americans who were eligible to file their taxes for free, sometimes luring them in with deceptive marketing. ProPublica reported that Intuit had even added code to its website to hide its free tax filing program from search engines such as Google. The company later removed the code.

Intuit still faces several other legal fights stemming from its “free” marketing.

The Federal Trade Commission is still pursuing legal action against Intuit over similar issues after suing the company in March under the federal law that prohibits unfair or deceptive business practices.

The agency’s suit asked the court to issue an emergency order forcing Intuit to stop its marketing of its products as “free” before the tax filing deadline on April 18. The judge ruled for Intuit in the lawsuit. But an internal FTC proceeding over the issues is continuing, with a hearing set for September.

Intuit said in its statement today that it believes “this settlement with the state attorneys general and the District of Columbia also addresses the issues at the core of the FTC litigation, making that lawsuit entirely unnecessary. Nevertheless, we are fully prepared to litigate with the FTC to prove the merits of our case.”

As ProPublica previously reported, more than 150,000 individual arbitration claims were also filed against the company by people seeking money back after they paid for software that, they said, should have been free. In a recent securities filing, Intuit said that on Feb. 23 it entered into a settlement agreement with consumers to resolve “a majority” of the pending arbitration claims without any admission of wrongdoing. The company hasn’t disclosed the terms of the settlement.