This article was produced for ProPublica’s Local Reporting Network in partnership with Outlier Media. Sign up for Dispatches to get stories like this one as soon as they are published.

Update, Nov. 18, 2022: The Michigan Public Service Commission voted on Friday to approve a rate increase totaling $30.56 million in revenue annually, less than 10% of the $388 million DTE Energy originally requested. Residential bills will increase by less than 1% as a result. The total represents the smallest increase approved for DTE in an electric rate case in at least a decade. The commission also directed DTE to provide it with more details about the impact of its low-income assistance program.

At the same time it pushed for a steep rate hike this year, DTE Energy was shutting off Michigan customers’ electricity for nonpayment at its fastest clip in at least nine years.

DTE, which serves the Detroit area, disconnected electric accounts 176,923 times from January through September of this year, more than in the first nine months of any year since at least 2013, an analysis by Outlier Media and ProPublica found. During the same period Consumers Energy, Michigan’s second-largest utility, disconnected accounts 63,982 times, less than half as often as DTE when adjusted for the number of customers.

In March, a first-of-its-kind analysis by Outlier and ProPublica showed that DTE’s shut-off rate during the COVID-19 pandemic outpaced all other Michigan utilities owned by private investors and regulated by the state.

The news organizations have since revealed how DTE — alone among Michigan utilities — sold customers’ debt to a private company, which sued in court, forced thousands of Detroiters into default judgments and led to garnished wages. The series has shed light on a regulatory system, common across the country, that can prioritize the financial needs of utility companies over affordability and consumer protection.

As it has in the past, DTE stressed that it tries to help customers avoid shut-offs. “We continue to work aggressively and proactively to get help to customers as soon as they experience difficulty with bills,” DTE spokesperson Christopher Lamphear said in a written response to questions.

He said that the company has “a range of safeguards that help prevent service interruptions” and that DTE has helped to secure financial aid for some customers struggling to pay their bills. Lamphear added that most people whose accounts are shut off have their homes reconnected “within one or two days.”

DTE is currently seeking approval from the Michigan Public Service Commission for a rate increase that would bring in an additional $388 million in annual revenue. The company has said it needs the extra money to fund infrastructure improvements that would prevent power outages and improve worker safety. It has not had a rate increase since before the pandemic.

As part of the review process, an administrative law judge made an initial recommendation in September to limit the DTE revenue increase to $145.7 million. The judge did not address either shut-offs for nonpayment or customer debt.

The state commission in recent years has typically approved requests from utilities to raise rates but for smaller sums than requested. Officials have stressed that Michigan law leaves the commission unable to consider the affordability of rates or the impact on customers, instead saying it can only evaluate if DTE’s proposed prices are “reasonable and prudent” for the utility to provide reliable service and satisfy investors.

“There’s not sort of a clear place in Michigan law where it gets to ‘And also can customers afford to pay for it?’” commission chairman Dan Scripps told Outlier and ProPublica this year.

Wayne Metro Community Action Agency, which provides energy assistance to low-income households, has noticed an uptick in requests for help recently. Executive Director Shama Mounzer attributes this, in part, to how inflation is squeezing budgets, the end of temporary pandemic related relief programs and “high bills.”

“Since Oct. 1, we have received over 3,200 requests for energy and gas assistance,” she said. “Around this time last year, we had 1,600 requests.”

As DTE seeks a rate increase, residents, community groups and politicians have voiced concerns about the impact on consumers. And some members of the Detroit City Council have criticized DTE for its debt collection and shut-off policies.

“Putting impoverished people in more economic anxiety right now is bad faith and bad practice for a provider that calls Detroit home,” said Ramses Dukes, legislative director for City Council member Angela Whitfield-Calloway. Dukes said DTE is scheduled to come before the council in January to face questions about how it treats customers unable to pay their bills.

This latest increase in shut-offs comes as a new report on debt collection lawsuits of all types in Michigan provides greater detail on what can happen after a utility disconnection. Some customers are pushed into the hands of debt buyers, including one that has purchased old DTE debt, which then flood the state’s court systems with cases where debtors are at a disadvantage.

For example, nearly 7 out of 10 debtors who were notified about their lawsuit lose by default. And defendants are also almost always legally outmatched by the plaintiffs: About 96% of creditors are represented by a lawyer, compared with fewer than 1% of debtors.

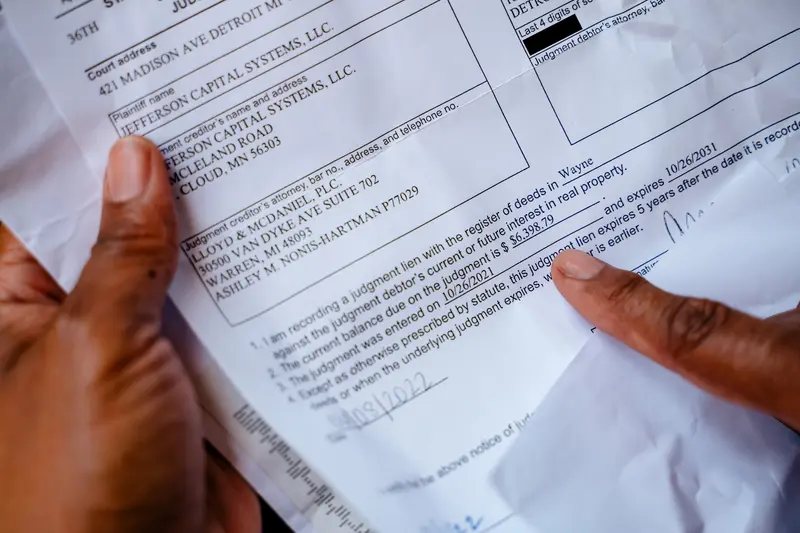

The report, issued by the Justice For All Commission, created by the Michigan Supreme Court to improve access to the civil courts, found that Jefferson Capital Systems was one of the most prolific companies filing debt collection lawsuits in the state.

Jefferson, which both purchases and collects debt, filed a disproportionate number of cases against people living in majority Black neighborhoods, the report said. DTE has sold its customers’ debt to Jefferson in the past — a tactic that was disclosed in an Outlier-ProPublica story. Jefferson has not responded to requests for comment.

Many of the commission’s recommendations focus on giving consumers more information as they navigate the court system. Its report calls for expanding the ways debtors are notified of lawsuits so they’re aware of the claims against them and increasing the evidence creditors must produce in order to file the lawsuit.

The latter would be a “game changer” for Michigan, according to Erika Rickard, project director of the civil legal system modernization project at Pew Charitable Trusts, which partnered on the report. The report recommends that creditors should have to provide proof of the amount of the debt owed and how the debt came into their possession. January Advisors, a data firm, also partnered on the report.

Angela Tripp, vice co-chair of the commission, said in a press briefing this week that her group would begin meeting with local courts and other members of the Michigan justice system in the coming months to begin implementing these recommendations.

Other efforts aimed at helping consumers, such as freezing utility rates or reducing shut-offs, have gained minimal traction.

Environmental justice advocacy groups that have intervened in DTE’s current rate case have asked the Michigan Public Service Commission to explicitly begin holding utilities accountable for their performance on affordability and clean energy offerings by opening up a separate case on these issues. The commission has not done so, however. Asked for comment, the commission said it could not comment on matters currently under review.

Right now the public service commission only has a voluntary work group called the Energy Affordability and Accessibility Collaborative. It includes advocates and meets regularly but has no power beyond issuing nonbinding recommendations.

The effort to get DTE to come before the Detroit City Council to discuss debt collection and shut-offs, meanwhile, has moved slowly. Members first pushed for such a meeting in April.

“We look forward to having a productive discussion with the Detroit City Council,” Lamphear said.

Agnel Philip contributed data reporting.