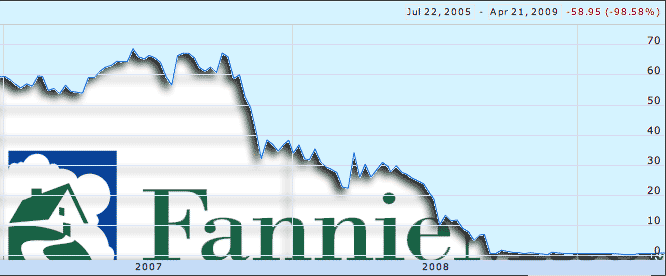

Fannie Mae needs $19 billion more from the Treasury Department, the company said in its first-quarter results released today. That brings its total bailout to $34.2 billion. Its twin, Freddie Mac, hasn't yet released its results, but it's also expected to require more taxpayer money, of which it's already received $44.6 billion. They're rapidly ascending our list of bailout recipients.

Fannie Mae needs $19 billion more from the Treasury Department, the company said in its first-quarter results released today. That brings its total bailout to $34.2 billion. Its twin, Freddie Mac, hasn't yet released its results, but it's also expected to require more taxpayer money, of which it's already received $44.6 billion. They're rapidly ascending our list of bailout recipients.

Fannie and Freddie's bailout funds don't come from the $700 billion TARP, but rather via a housing bill passed last July. Treasury Secretary Tim Geithner has said that Fannie and Freddie could get as much as $200 billion each. Since a government takeover last September, the two companies have continued to operate, albeit with close oversight.

In its release today, Fannie said its $23.2 billion loss was mostly driven by a $20.3 billion provision for credit losses on its home loan portfolio. Delinquency and default rates are way up, the company said, particularly for "loans on properties in California, Florida, Arizona and Nevada, loans originated in 2006 and 2007, and loans in higher-risk categories such as Alt-A loans and interest-only loans."

Under its agreement with the government, the Treasury fills the company's net-worth deficit at the end of each quarter. The $23.2 billion in losses led to a $19 billion deficit, and taxpayer money will fill the hole.

It will likely continue to fill that hole for some time to come, the company said in its release: "we expect to have a net worth deficit in future periods, and therefore will be required to obtain additional funding from the Treasury."

Those losses are likely to be exacerbated by Fannie's participation in the administration's mortgage modification program. Under the plan, Fannie and Freddie will step up refinancing for loans they own or guarantee that normally wouldn't qualify. Troubled loans that Fannie and Freddie own or guarantee will also be modified under the program. Precisely how much they lose (and how much it will cost taxpayers) isn't clear. The administration's ballpark figure is that the program will cost Fannie and Freddie together $25 billion.

Of course, Fannie isn't participating in the program to help its bottom line; it's being used as part of the administration's strategy to reduce foreclosures, lower mortgage rates and stabilize the housing market.

In the release, the company admits these losses are inevitable, but nevertheless attempts a positive spin for the company's future: "If, however, the program is successful in reducing foreclosures and keeping borrowers in their homes, it may benefit the overall housing market and help in reducing our long-term credit losses."