In our story last month about a tobacco bond bailout by New York's Niagara County, we noted that another county, Chautauqua, also had a deal in the works involving its distressed bonds.

Now the deal is done, and it seems Chautauqua fared even worse than its nearby upstate neighbor.

Oppenheimer Funds, the New York mutual fund manager, got $5.9 million to cash out of a speculative Chautauqua tobacco bond issue it had recently valued at only about a fourth of that amount. The firm declined to comment on the deal.

County taxpayers got $600,000, or about one-tenth of Oppenheimer's take. Just the fees necessary to get the deal done – $1.2 million paid to lawyers, bankers and others – were more than double Chautauqua's take.

"It is rare to see the issuer getting so little compared to the cost of issuance," said Matt Fabian, managing director at Municipal Market Advisors, a Massachusetts-based research firm.

In Niagara's recent tobacco bond bailout, the county got to keep about $2 million, a little less than a third of Oppenheimer's take of about $6.9 million. As with the Chautauqua deal, that was about four times value Oppenheimer reported on its books, according to mutual fund data provider Morningstar.

What's going on?

As we've reported previously, it all started with a massive legal settlement in 1998 under which big tobacco companies agreed to pay billions of dollars in compensation to states and U.S. territories like Puerto Rico for the health care costs of smoking. New York and California also shared the proceeds with county governments and some cities.

The money is paid out in yearly increments, but to get cash up front, many of these governments turned to Wall Street. They created special tobacco corporations and sold bonds to investors like Oppenheimer, agreeing to repay the debts exclusively with the tobacco income.

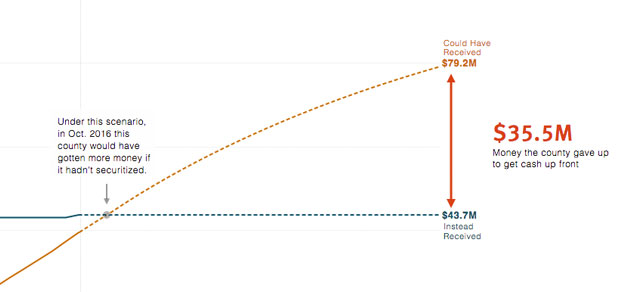

The Millions New York Counties Coulda Got

Chautauqua securitized three times, and has currently pledged 100% of its annual tobacco payments to investors. Had it not made these upfront deals, it could have collected $79.2M by 2040. Instead it may only collect $43.7M. See more counties in our interactive »

Years later, many of those bonds are headed for default. That's in part because less money is coming in under the legal settlement than expected, and also because some of the riskiest bonds – called capital appreciation bonds, or CABs – are piling up so much interest that they may never repay. As long as they remain outstanding, tobacco money coming in goes to investors and not the governments.

That was Chautauqua's situation.

The county of 133,000 participated in a 2005 CAB issue alongside 23 other New York counties. These CABs collectively obligated the counties' tobacco corporations to pay back nearly $6.8 billion. The debt was so big that Chautauqua said it might never see its tobacco money flow back to taxpayers.

Had Chautauqua never issued tobacco bonds, the county would have collected about $2.5 million this year from the settlement for its own uses. That might have come in handy now as the county is looking to close a $6 million budget deficit beginning in 2016.

County officials say the $600,000 received from the restructuring deal, which closed Nov. 6, will help fund a new facility for storing and maintaining highway equipment, such as snow plows. The county said it also benefits by avoiding the "likelihood of default." The CABs the county bought out in the deal would have required a gargantuan $373.5 million payment on June 1, 2060.

The tradeoff is more debt today. The transaction refinances $27.5 million of senior tobacco bonds at a lower interest rate, but it increases the amount borrowed to $34.8 million. Most of the increase in principal went to buy out Oppenheimer, which still holds two additional sets of Chautauqua CABs.

Once Chautauqua's remaining tobacco debts get repaid, it can again start collecting settlement money for taxpayers' benefit.

"Eventually, there will be some residual proceeds from this refinance that will come back to the county," Chautauqua County Executive Vincent Horrigan said in an interview.

"It's quite a ways off," he added.

Under the deal, the remaining CABs would be repaid in 2049.

With dozens of other governments sitting on these distressed tobacco debts, Fabian said he expects more will follow the same path.

"The Wall Street way," he said, "is to keep doing something until it doesn't work anymore."