Here it is: a timeline showing how AIG went from boasting about how the subprime mortgage crisis was no problem at all to being the American taxpayersâ problem. Assurances from AIG executives continued even as losses mounted – assurances that have reportedly drawn the curiosity of federal investigators.

Here it is: a timeline showing how AIG went from boasting about how the subprime mortgage crisis was no problem at all to being the American taxpayersâ problem. Assurances from AIG executives continued even as losses mounted – assurances that have reportedly drawn the curiosity of federal investigators.

As weâve noted before, the main cause of AIGâs collapse was its credit-default swap portfolio. The swaps were essentially insurance contracts on securities, and for a fee, AIG guaranteed the securityâs value. The problem: If the prices of the securities collapsed, AIG was on the hook. Because the portions of the securities that AIG guaranteed were judged to be almost risk free, not much thought seems to have been given to that scenario.

At the end of 2007, through its swaps, AIG covered about $61 billion in securities with exposure to subprime mortgages.

That portion of the swaps wreaked havoc on AIGâs health in two ways.

First, the company was forced to post mounting losses as the value of the securities AIG was guaranteeing deteriorated. AIG assured investors these losses were only paper losses – "unrealized losses" in accounting lingo – and that the securities were sure to regain their lost value before AIG would be forced to pay up.

Second, AIG was vulnerable to collateral calls, and it was this that ultimately sunk the company. According to the contracts AIG had with its counterparties (its clients) in the swaps trades, AIG agreed to put up money if the value of the securities deteriorated or AIG itself became less creditworthy.

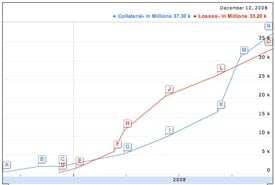

Starting in the summer of 2007, AIGâs counterparties began demanding that AIG put up collateral. As you can see below, the number steadily mounted until the company collapsed from the strain.

Under the governmentâs latest deal, the Fed has helped AIG pay its obligations to those counterparties. The identity of those banks remains officially under wraps, but the Wall Street Journal has named a number of them: Goldman Sachs, Merrill Lynch, UBS, Deutsche Bank, Barclays, Credit Agricole, Royal Bank of Scotland, CIBC and Bank of Montreal. As the Journal reported, the banks are sure to be happy with the deal, even if the U.S. taxpayer might not be.

August 5, 2007: During a conference call with investors, various high-ranking AIG officials stressed the near-absolute security of the credit-default swaps.

"The risk actually undertaken is very modest and remote," said AIGâs chief risk officer.

Joseph Cassano, who oversaw the unit that dealt in the swaps, was even more emphatic: "It is hard for us with, and without being flippant, to even see a scenario within any kind of realm of reason that would see us losing $1 in any of those transactionsâ¦. We see no issues at all emerging. We see no dollar of loss associated with any of that business."

"Thatâs why I am sleeping a little bit easier at night," said Martin Sullivan, AIGâs CEO.

August, 2007: Goldman Sachs, a big swaps customer of AIG, demands that AIG post $1.5 billion in collateral to cover some of its exposure. AIG privately agrees to post $450 million.

October 1, 2007: Joseph St. Denis, the VP of Accounting Policy at AIG Financial Products, resigns (pdf) after Cassano tells him, "I have deliberately excluded you from the valuation of the [credit-default swaps] because I was concerned that you would pollute the process."

Late October, 2007: Goldman asks AIG to post another $3 billion in collateral. AIG privately agrees to post $1.5 billion.

November 7, 2007: In an SEC filing, AIG reports $352 million in unrealized losses from its credit-default swap portfolio, but says itâs "highly unlikely" AIG would really lose any money on the deals.

The company also discloses that there have been disagreements with some of its counterparties (the banks in the U.S., Canada and Europe that had purchased the swaps) about the "collateral required." The report does not disclose how much collateral AIG has been forced to post, however.

November 29, 2007: An auditor from PricewaterhouseCoopers, AIGâs outside auditor, privately warns AIG CEO Martin Sullivan that AIG could have a "material weakness" in its risk management (pdf) of the swaps.

December 5, 2007: In an SEC filing, AIG discloses $1.05 billion to $1.15 billion in further unrealized losses to its swaps portfolio, a total of approximately $1.5 billion for 2007.

During a conference call with investors, CEO Martin Sullivan explains that the probability that AIGâs credit-default swap portfolio will sustain an "economic loss" is "close to zero."

AIGâs risk-modeling system had proven "very reliable," Sullivan said, and since the transactions were so "conservatively structured," AIG had "a very high level of comfort" with its risk models.

Federal investigators are probing whether Sullivan and other AIG executives misled investors at this meeting, according to the Wall Street Journal.

February 11, 2008: AIG discloses in a regulatory filing that its auditor, PricewaterhouseCoopers, has found a problem: a "material weakness" in its valuation of the swaps. AIG therefore needed to "clarify and expand" its prior disclosures.

AIG puts the unrealized losses of its swaps portfolio at $5.96 billion through November 2007.

February 28, 2008: In its year-end regulatory filing, AIG sets its 2007 total for unrealized losses at $11.5 billion. AIG also discloses that it had thus far posted $5.3 billion in collateral. Itâs the first time the company has disclosed the amount of posted collateral. AIG puts the notional value of the entire swaps portfolio at $527 billion. But as we said above, about $61 billion of the swaps had exposure to subprime mortgages.

The next day, CEO Martin Sullivan tells investors that AIG expects those losses to "reverse over the remaining life" of the portfolio. These losses, he said, were "not indicative of the losses AIGFP may realize over time."

AIG also announces that Joe Cassano, the chief of the unit that dealt in the swaps, has resigned. What AIG doesnât disclose is that heâs kept on under a $1 million per month consulting contract.

May 8, 2008: In its first quarter filing, AIG ups its estimate of its unrealized losses in 2008 to $9.1 billion through the end of March, for a grand total loss of $20.6 billion over 2007 and 2008. It also discloses that it had posted an aggregate of $9.7 billion of collateral over the past two years.

May 20, 2008: AIG raises $20 billion in private capital to help with the growing problems.

August 6, 2008: In its second quarter filing, AIG ups its unrealized loss in 2008 from the credit-default swaps to $14.7 billion, for a grand total loss of $26.2 billion. It also discloses another impressive number: Itâs posted a total of $16.5 billion in collateral.

September 15, 2008: Standard & Poorâs cuts AIGâs credit rating due to "the combination of reduced flexibility in meeting additional collateral needs and concerns over increasing residential mortgage-related losses."

AIG is forced to raise another $14.5 billion in collateral due to the rating downgrade. The company faces collapse.

September 16, 2008: The Federal Reserve Board saves AIG by pledging $85 billion. As part of the deal, the government gets a 79.9 percent equity interest in AIG.

October 8, 2008: The Fed pledges another $37.8 billion to AIG.

November 10, 2008: AIG discloses that it had thus far posted a total of $37.3 billion in collateral on the swaps. It estimates its total unrealized losses from the credit-default swap contracts for 2007 and 2008 at $33.2 billion.

The government and AIG announce that theyâve reached a new agreement for a total of $150 billion. As part of the agreement, the New York Fed, together with AIG, will purchase the worst-performing securities covered by the credit default swaps, going to the root of the problem.

The swaps covering these âmulti-sectorâ CDOs (collateralized debt obligations), at a notional value of approximately $72 billion, were the cause of almost all of AIGâs losses and collateral postings (about $61 billion had exposure to subprime mortgages). Purchasing the securities themselves will terminate the swaps. The Fed will advance $30 billion and AIG $5 billion. The banks get to keep AIGâs collateral. Together, the sums exceed $72 billion.